- Buy-Side Insights Newsletter

- Posts

- No. 13

No. 13

EP 7 $TUSK – Buffett Punchcard pick ● Updates to the Job Board ● Commentary on recent hedge fund moves ● 8 PM biases to avoid ● EP 8 $VSTS - Earnings Process

Now Available:

●$TUSK: Deep value: 20% below cash, 60% below NAV, and pivoting to higher return industrials. Our first Buffett Punchcard. Now available on all streaming platforms.

● Updates to the Job Board

● Why the Big 4 Are Doubling Down on Commodities

● Zoom top UCaaS ranking

● FIG model from InSync Analytics and Capital Markets Process Color

● 8 PM biases to avoid

Coming Soon:

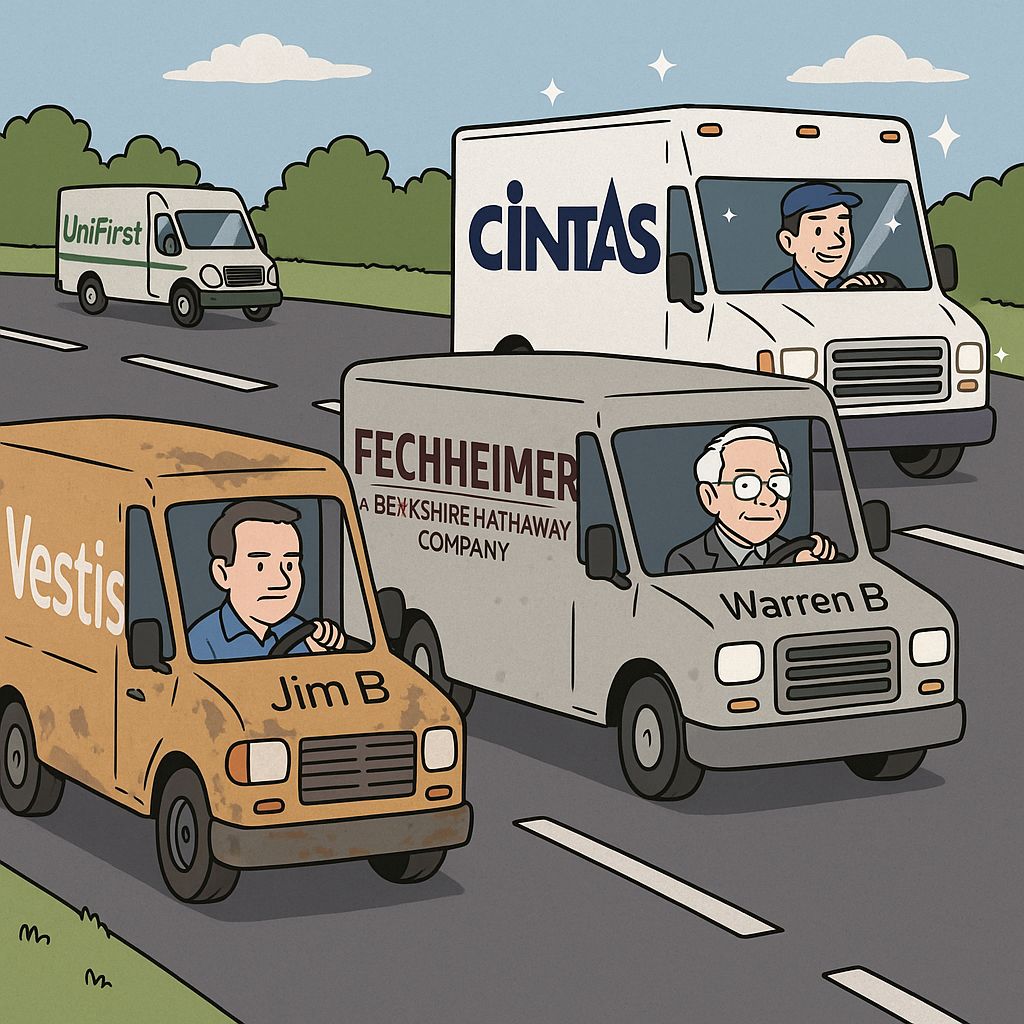

🔜 $VSTS: “Sandbagged guidance and new CEO’s turnaround plan could cause a short squeeze on print”

🔜 SemiAnalysis roundtable discussions with DougO’Laughlin, President on all things semi-conductors and AI

🔜 From Fidelity PM to Hilliards Chocolate - inspired by a car with chauffeur Warren Buffett!

VSTS episode dropping soon - Can Jim Barber turn it around?

EP 007: TUSK now available

In case you missed it, EP 007 on TUSK is now available. In this episode, Doug sat down with Mark Layton, CFO of Mammoth Energy Services ($TUSK), to unpack one of Doug’s highest conviction ideas, and the first company He has stamped on his Buffett Punchcard.

TUSK is a $132M market cap company trading below net cash. The market’s assigning zero value to the legacy businesses or the $145M worth of equipment recently appraised.

They just sold their largest industrial business for $110M (3x MOIC), closed a $15M frac sale after our recording, and are now targeting 25–35% unlevered IRRs in a niche aviation rental strategy, backed by their largest shareholder, Wexford.

Mark also walks through how they’re quietly incubating engineering, fiber, and equipment rental arms. If you're looking for cigar butts morphing into compounders, this is worth a close listen.

Click the image below to watch the full discussion.