- Buy-Side Insights Newsletter

- Posts

- Buy-Side Insights No. 9

Buy-Side Insights No. 9

● The "GPU Whisperer" Drop ● $PLTR Drop Next ● NVDA Feedback from a LO Tech PM ● Is Ken Griffin on the same path as Ross Perot? ● The Science of Hitting ● Top 10 Takeaways From the Apprentice Program

Calendar

Episode Drop!

● The GPU Whisperer — featuring Aaron Ginn, CEO of Hydra Host

Hydra Host is a private SaaS GPU manager for data centers powering $250 MM in revenue. If you haven’t read his op-eds, Ginn is one of the sharpest minds in AI today. We dig into the fast-moving GPU industry and cover:

1) What America (read: Nvidia) needs to do to stay ahead of China in AI

2) Why Nvidia is winning, and whether those sky-high semi margins will last

3) The grim reality for Amazon, Google, and Microsoft clouds in GPU data centers Watch the “GPU Whisperer” Here

In The Pipeline:

🔜 $PLTR episode with Adam Parker drops soon: Irrationally Overvalued - Historical Index Rebalance Could be the Catalyst to Break it.

🔜 $TUSK: Deep value: 20% below cash, 60% below NAV, and pivoting to higher return industrials. We sit down with the CFO of Mammoth Energy Services, Mark Layton. Subscribe on YouTube for drop notifications.

🎓 Education:

🕵️♂️ Forensic Accounting 101

One-day workshop on July 24 in NYC with a former Tiger Cub partner. Learn how to spot the accounting tricks management teams don’t want you to see.

Register & get $100 off with the code “Doug”

Job board

📬 Now delivered straight to your inbox. Sign-up to stay in the loop on the latest roles and opportunities.

AlphaSense Presents: The “GPU Whisperer”

AI, Data Centers, and Hydra Host’s Edge

We’re digging deeper on our AI/Cloud/Data Center research with an interview featuring Aaron Ginn, the CEO of Hydra Host — a private SaaS GPU management company set to do $250MM of revenue.

Here’s what we dig into:

1) Why it’s unlikely that Google and Amazon's chips will replace Nvidia's in third-party data centers, and why the real competition is China.

2) The sales tactics Google and Amazon are using to win over big-name customers, even while those same customers still run Nvidia.

3) What Nvidia’s margins could look like going forward — 75%? 65%? 50%?

4) How GPU contracting really works, including depreciation and useful life.

👇 Click the image below to get view the webinar now.

NVDA Feedback from a LO Tech PM

FEEDBACK: I think you present a valid thesis for being short NVDA . It’s a bold and difficult call, especially given the strong momentum in both the business and the stock. The turning point will likely come when the narrative shifts from SECULAR to CYCLICAL or when there is meaningful competitive displacement, both of which are central to your thesis and, to be fair, are almost inevitable over the long run. We’ve seen similar dynamics before, such as with servers in the 1990s.

REPLY: I like a WHEN not IF thesis. And there are mixed signs of the narrative shifting from SECULAR to CYCLICAL. GPU rental pricing is off highs. Investors are starting to talk about returns & not just growth & use cases. Stock prices of GPU buyers can foreshadow capex changes

FEEDBACK: What’s harder to gauge is where the top is. Many data points suggest we’re still in the early innings of AI use cases, and there's little evidence yet of a material slowdown across key end markets in terms of capex. Hyperscalers, enterprises, sovereigns cumulatively are still expected to grow, with multiple drivers including inference, sovereign AI, enterprise applications, & industrial AI use cases. Not all have to work for NVDA to meet its numbers over the next few qtrs + they remain supply-constrained for now.

REPLY: Timing the top is hard without a crystal ball. A portion of the AI investments seem speculative

FEEDBACK: On the ROI argument: while I agree with your examples showing limited near-term returns, there are also cases where AI has demonstrably supercharged businesses. For instance, AppLovin and Meta have significantly improved targeting, engagement, and ad utilization, resulting in stronger margins and ROIC leading to expanding their moats meaningfully.

REPLY: I like META and ZM as AI use winners. I own both.

FEEDBACK: Timing momentum here is tough. Personally, I’d prefer to short companies in the AI ecosystem that are more vulnerable to competitive pressure. NVDA’s moat is built across hardware, software, and networking, and it’s hard to displace that with NVLink and their full-stack integration. I’d be more inclined to short companies in the networking layer. For example, ANET is facing rising competitive intensity, with NVDA announcing its own scale-up platform, Celestica launching their own switches, and the continued white-boxing across the industry.

REPLY: I will do research on those, thanks. I agree, Nvidia has a great product, market share and some barriers. My concern is what is priced-in at a 3% FCF yield - can they earn this for 33 yrs?

FEEDBACK: That said, you will likely eventually be right, the question is when.

REPLY: Agree, timing is the key! I have had the position for a year.

Is Ken Griffin on the same path as Ross Perot?

Let’s look at the parallels:

1) Both made billions in business.

Perot founded Electronic Data Systems (EDS) in 1962, one of the first companies to offer outsourced IT services to corporations and government agencies. He sold it to GM in 1984 for $2.5B.

Griffin, of course, built Citadel into a global powerhouse in hedge funds and market-making. Two visionaries.

2) They both loaned the government historical documents from their personal archives.

- In 1984, Perot loaned a 1297 version of the Magna Carta to the National Archives.

- Last month, Griffin loaned his copy of the 1787 U.S. Constitution and a first printing of the Bill of Rights. He also donated $15MM to the National Constitution Center ahead of America’s 250th anniversary. https://lnkd.in/e7ggTcUs

3) Both suffered big losses and came back stronger

- In 1970, Perot's $1 billion stake in EDS crashed by $445MM in a single day. He took the hit and kept building.

- In 2008, Citadel's flagship fund fell 53%. Griffin stayed the course and kept swinging, becoming the best HF manager of all time.

4) They both went to great lengths to protect their teams

- In 1979, Perot funded the rescue of two EDS employees from an Iran prison

- In 2015, Griffin funded the emergency air-transport of a sick employee on vacation (a friend of mine) at a second tier foreign hospital to the U.S., where he was diagnosed properly and his life was saved.

5) Political aspirations?

- Perot ran for president in 1992 and 1996

- Griffin has become increasingly popular on the media circuit and with philanthropy. He recently said on a podcast that he’d serve if asked. If I were a betting man (and you know I am!), I’d put money on him making a run for the Oval Office. And we could all be so lucky.

Note: I’m not affiliated with Citadel.

See Richard Toad’s Ross Perot linkedin post here:

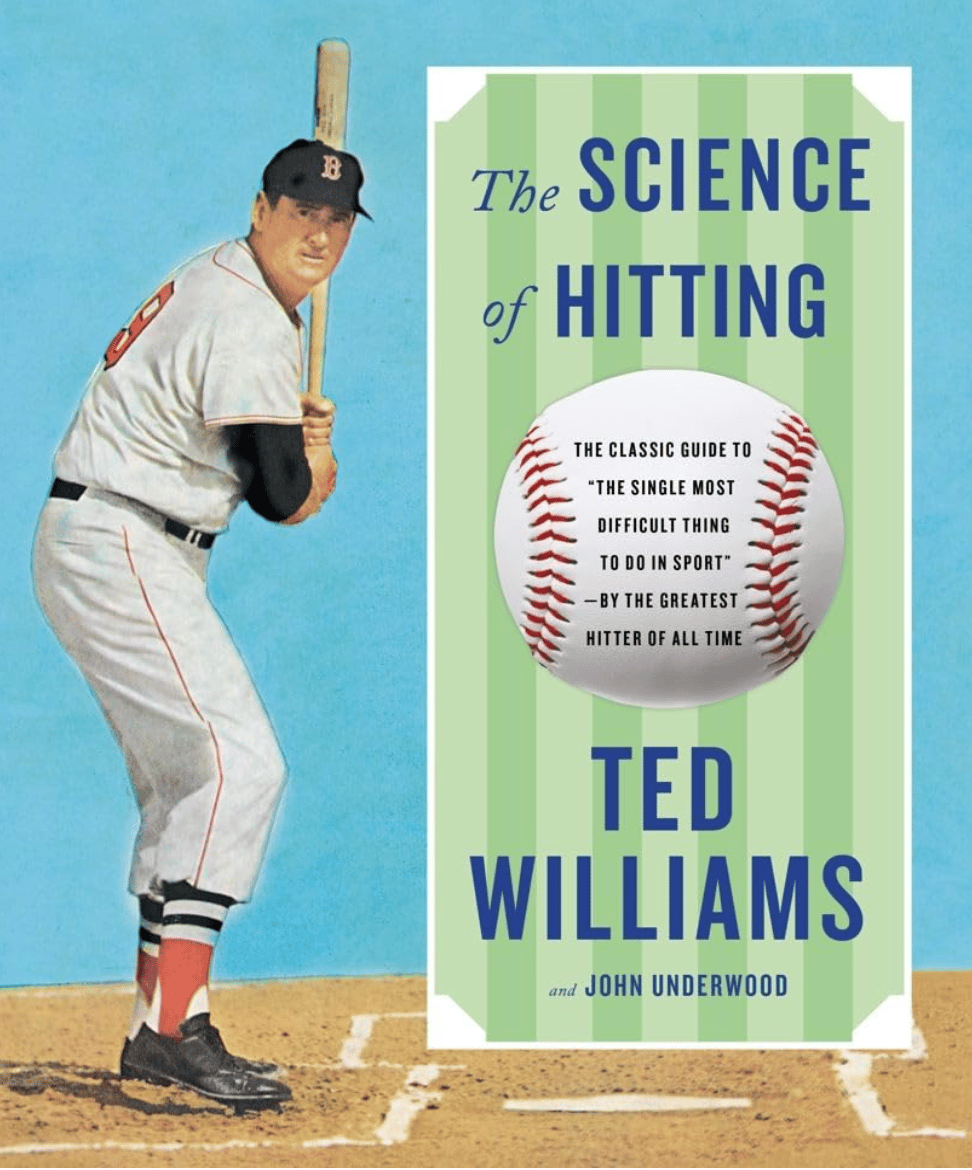

⚾️ The Science of Hitting ⚾️

“Legendary investors know when they have an advantage and they press it. They’re confident in their conviction, and when they’re wrong they move on, they just let it go and move on.”

— Ken Griffin

🎥 Watch the Ken Griffin Stanford Discussion HERE

A few thoughts on pressing your edge, and knowing when not to swing:

1) Legendary investors know when they have an advantage. Check out our Punch Card #1 post from May 23, 2025 on $TUSK.

2) I was in that "Best" category Ken describes....and that is a good hit rate for that model when there is a set universe and you essentially have to deploy capital and swing.

3) I am now learning new lessons from Buffett who learned from "The Science of Hitting" by Ted William, where the hit rate was much higher when he swung at balls in his best cell out of the 77 possibilities...and the famous quote is "there are not called strikes in investing" by Warren Buffett

4) My new goal is to get my hit rate much higher than 54% by swinging less as I go from a pod shop mentality to a concentrated investor mentality like Buffett and Greenblatt, etc…

Top 10 Takeaways from Apprentice Program Lesson 3

Another great session from the Pitch the PM Apprentice Program. This time, Hugh Anderson, a former SAC & Lombard PM, dropped some real gems:

1) Math is not an investment edge. Insight is.

2) Do you want to be right or do you want to make money?

3) Think in probabilities.

4) Know when to admit you’re wrong.

5) Don’t go off the cliff, protect the downside.

6) Get in the field. Pick up the phone. Talk to people.

7) Beware the sensation of knowing.

8) Take emotion out of it.

9) Why are $XOM and $CVX fighting over Guyana?

10) Has U.S. shale peaked? Use a checklist to think it through

We have 124+ apprentices already, ranging from Students to VP Research Analysts to the C-Suite. If you want to level up on buy-side investing, click the image below to join the group!

This lesson was brought to you by DoTadda - AI for Analysts by Analysts.

- Get a free 3 month trial at knowledge.dotadda.io by creating an account and emailing [email protected] "Pitch"

- DoTadda is a GREAT resource for making the research process more efficient for Analysts; the prompts have proprietary coding that was created and is iterated upon weekly by a seasoned LO Analyst Andrew Meister for his own use and he is now sharing that with other investors too. Try it and send him your feedback.

Click the image below to join the group on LinkedIn and receive updates on future meetings!

About Us

My goal, as Charlie would say, “is to try to be useful.”

Pitch The PM is the Professional Investor's Podcast that provides a deep-dive into a stock's investment case using the Variant View Investment Checklist. It is an open exploration of the research process in real time using high-conviction ideas from top PM’s and Analysts. Join the journey as Doug fills out his Buffett advised, 20-slot lifetime punch card. We learn and laugh together.

The Variant View Investment Checklist is the process that combines:

A decade of experience managing $1B at Citadel & Millennium,

Studying the great investors like Buffett, Munger, Lynch & Greenblatt,

and the latest AI tools to improve idea velocity, accuracy and conviction.

Westport Alpha Group is a family office consortium of like minded finance professionals. Individuals may engage in Special Purpose Vehicle’s (SPV’s), Separately Managed Accounts (SMA’s) or act as an Independent Sponsor for a private company or in a public company take-private. This is not a solicitation to sell/buy any security or engage in any services. This is not an attempt to form a group.

Pitch The PM is hosted by Doug Garber, a former Citadel Analyst and Millennium Senior Portfolio Manager. Doug was initially trained at Citadel by a former SAC/Point 72 Analyst who worked directly for Steve Cohen before becoming a PM at Citadel. Doug was ranked as a top five analyst while at Citadel’s Surveyor Capital and was the only one to receive that designation twice during his tenure. He managed a multi-sector, multi-strategy team at Millennium under Katahdin Capital. Prior to his buy-side career, Doug worked in sell-side equity research honing modeling and primary research skills. Doug is currently the CIO and DoR at the Westport Alpha Group.

Doug graduated from Tulane University with a BSM and Master of Finance. He was selected to participate in the Darwin Fenner Student Managed Endowment Fund that utilized quantitative factors to outperform its benchmark and be an Investment Research Manager in the Burkenroad Reports “Stocks Under Rocks” equity research program. Doug has a passion for iterating on the investment process and a quirky sense of humor. He lives in Westport, CT with his wife, Lexi, and three kids. When he is not reading a 10-K, you can find him coaching youth soccer, inverted on his yoga mat or on an eFoil looking for Zuck.

Disclaimer

Past performance is not indicative of future results. Neither Pitch The PM nor its author (s) guarantee any specific outcome or profit. You should be aware of the real risk of loss in following any strategy or investment discussed in this material or on the show. Strategies or investments discussed may fluctuate in price or value. Investors may get back less than invested. Investments or strategies mentioned on this website or on the show may not be suitable for you. This material does not take into account your particular investment objectives, financial situation or needs and is not intended as recommendations appropriate for you. You must make an independent decision regarding investments or strategies mentioned on this letter, on the website or on the show. Before acting on information on this website, in this letter or on the show, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser.

The author (s) of this report may have positions in the securities discussed. The positions may change at a future date and neither Pitch The PM nor any authors are under any obligation to update you. The information may not be accurate and you should do your own research.

This is for educational purposes only. This is not investment advice. Please contact your financial advisor to see what is suitable for you. Please see disclosures at PitchThePM.com